Featured Post

How To Calculate Pip Value With Leverage

- Get link

- X

- Other Apps

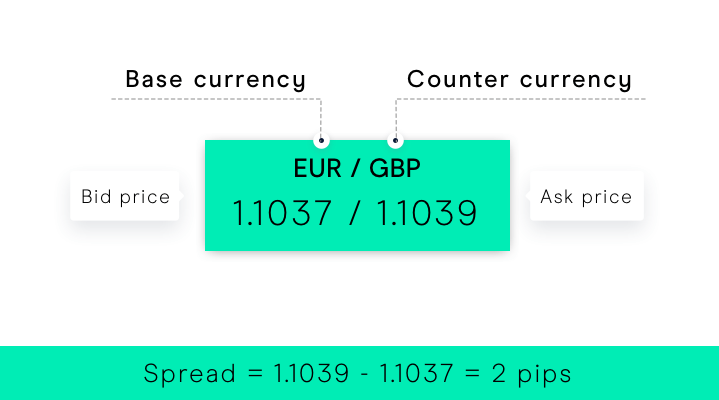

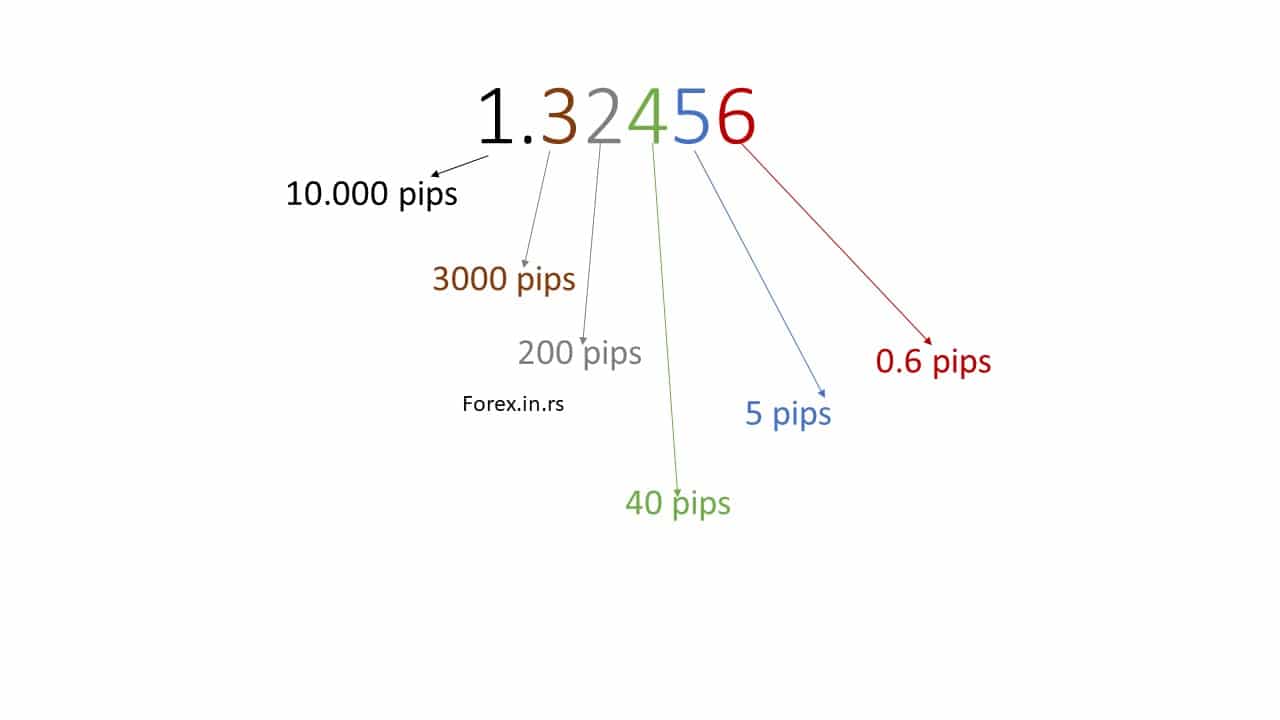

In a majority of currencies a pip equals 01 of the currency so 10000 pips 1 unit. The weighted average forex leverage calculator value of the ratio and rate for each pending order sort is used when taking into account the margin ratio and converting margin foreign money to deposit foreign money.

For example if the CADJPY is priced at 79941 to find out the standard pip value divide CAD10 by 79941 then multiply the result by 100 for a pip value of CAD1251.

How to calculate pip value with leverage. You calculate pip value as follows. 73 rows Pip Value 00001 1100000 10. Dollar-denominated account you need to divide the position size by the exchange rate.

100 pips 1 cent and 10000 pips equal 1. A 10 1 ratio 1 10 01 10. Pip Value Pip x Trade Size Exchange Rate 00001 x 10000013 13.

Hence the value of each pip of your trading position is worth 897. Dollar when it comes to pip value. - How to calculate a pip value- How position size affects pip val.

To get the value of each pip you have to multiply the monetary value by the lot value. To make things a little more concrete lets examine the US. To calculate the pip value where the USD is the base currency when trading in a US.

Instruments priced to 4 decimal places. In the next step multiply that number by your lot size. How to Calculate Pips and Leverage.

How to Calculate Pip Values. For example the pip value of a 100000 standard lot is 10 100000 x 00001. For example to calculate the value of the pip in the USD CAD currency pair divide 10 at the USD CAD rate when trading in an account in US dollars.

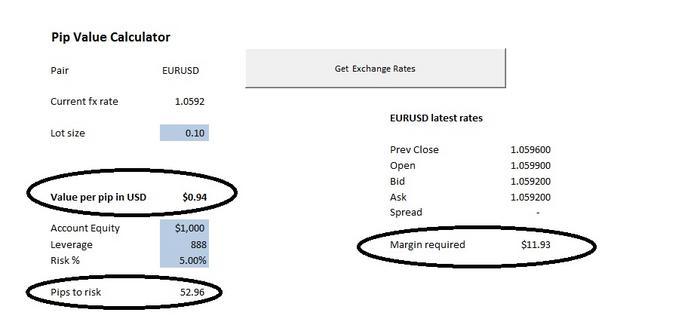

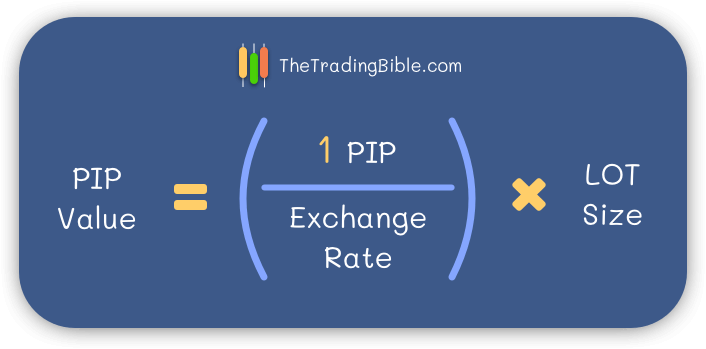

In this video you will learn- What a Pip is and the difference between pips and pipettes. The number of base units you are trading. To calculate the pip value divide one pip usually 00001 for major currencies by the currency pairs current value.

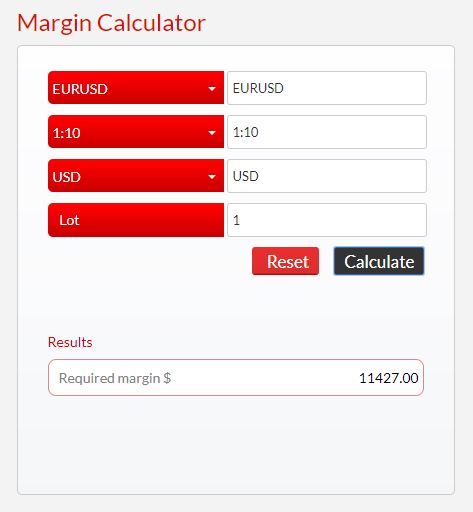

The amount of leverage the broker allows determines the amount of margin that you must maintain. 1 Lot 100000 EUR Pip Value 00001 108962 100000. Leverage 1Margin 100Margin Percentage.

Leverage is inversely proportional to margin which can be summarized by the following 2 formulas. Instruments priced to 2 decimal places. The calculation is performed as follows.

A 1001 leverage ratio yields a margin percentage of 1100 001 1. Whatever currency the account is funded in when that currency is listed second in a pair the bull and bear market are fixed. Investing involves risk including the possible loss of principal.

108962 EURUSD Lot Size. A 2001 ratio yields 1200 0005 05. A lot of people are confused about pips forex meaning and the forex trading pip valueYou need the value per pip to c.

Units X 001 X conversion to USD Pip value. For example if the exchange rate is 13 trading size 1 lot and currency pair EURUSD then. The calculation is here-.

However if your account is denominated in EUR. Pip Value One Pip Exchange Rate x Lot Size. How do I calculate the Pip value.

One Lot 100000 EUR. Leverage is inversely proportional to margin summarized by the following 2 formulas. Units X 0001 X conversion to USD Pip value.

Instruments priced to 3 decimal places. How to calculate pips in forex trading. If you have 10000 in your account and a leverage ratio of 1501 you will have 15 million 10000 x 150 or 15 lots 15000000100000 to invest.

To reach the pip value of a position it follows the formula Pip Value Lot Size 1 pip. If the USD CAD rate is 12500 then the value of the pip is 8 or 10 per standard dollar which should be 125. This is the equation in most cases but a well-known exception is the Japanese Yen.

Lets stick with EURUSD for this example. Units X 00001 X conversion to USD Pip value. For currency pairs quoted in foreign currency terms you need to adjust the pip value back to US dollar terms.

We will need the following information. In the case of EURUSD a position of 25000 would have a pip value of 25000 0001 25. Pip Value 00001 10904 x 100000.

The pip value quantifies this change. Each pip is worth 917 euros. Pip Value One Pip Exchange Rate Lot Size.

Choose the exchange rate from the out there charges in the pip calculator. A 50 1 leverage ratio yields a margin percentage of 1 50 002 2.

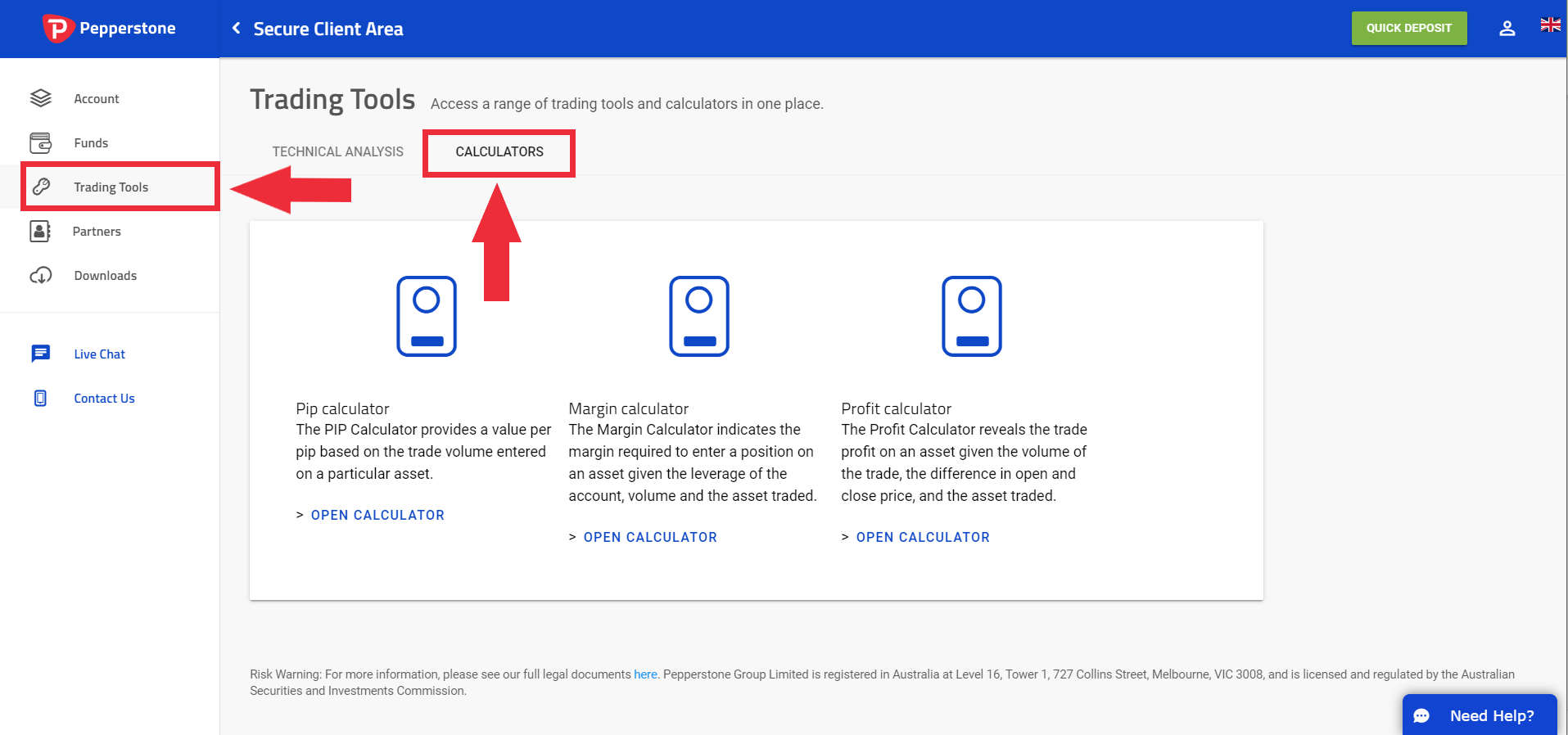

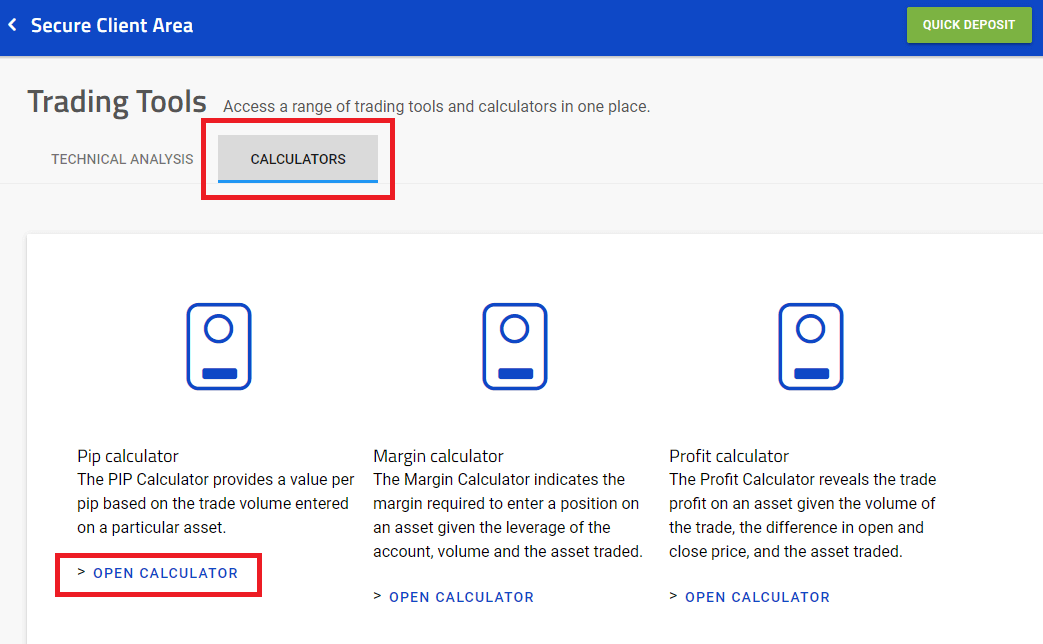

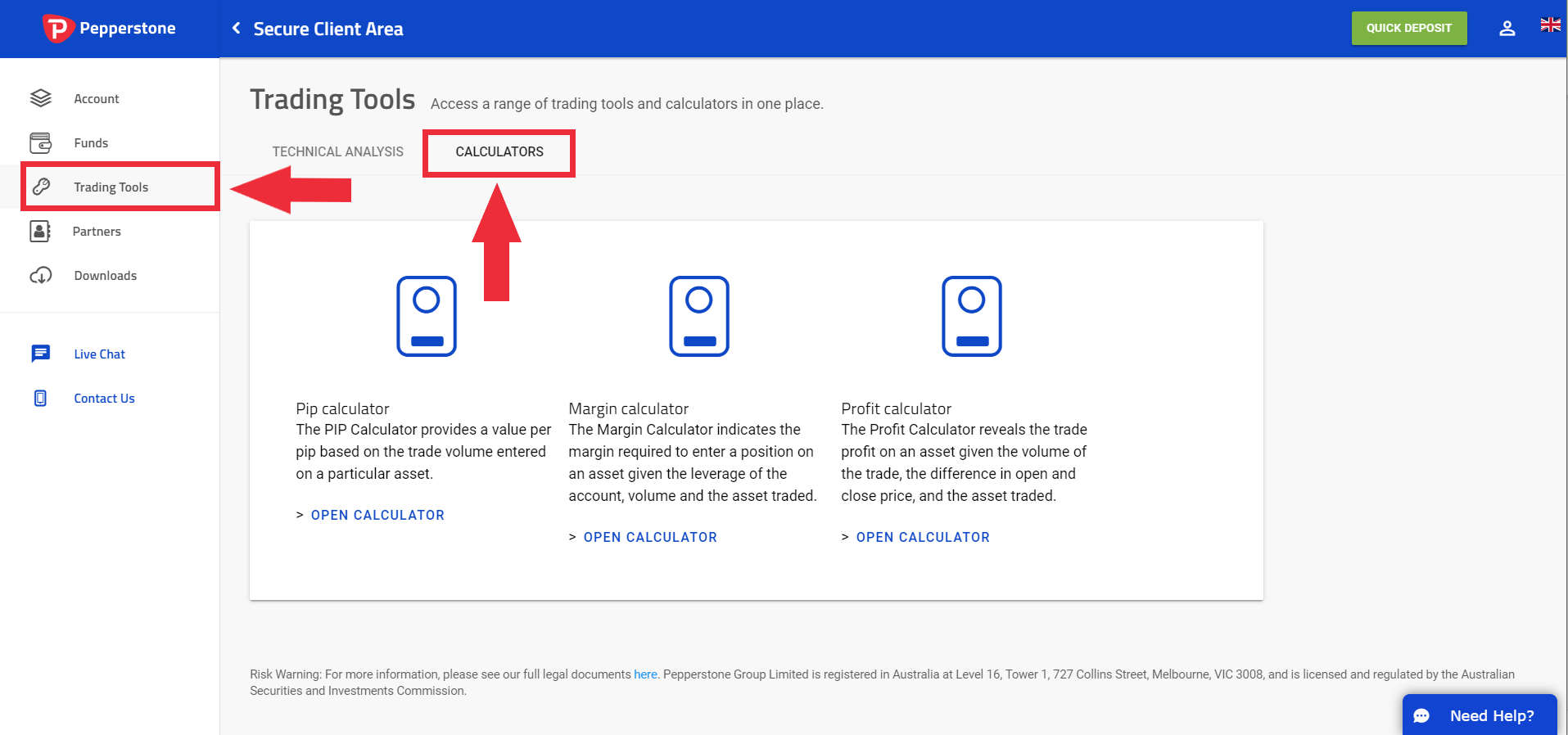

Pepperstone How To Calculate Pip Likerebateforex

What Is A Pip In Forex Investoo Com Trading School Brokers And Offers

Pips In Forex Values Pip Calculator Cmc Markets

What Is A Lot In Forex Trading Lot Sizes Explained

Leverage Pip Value And Risk Management Beginner Questions Babypips Com Forex Trading Forum

Forex Calculators Margin Lot Size Pip Value And More Forex Training Group

How To Calculate Pip Value Risk Trade Size Tutorial For Forexcom Eurusd By Alec40 Tradingview

How Can I Calculate Pip Value Faq Pepperstone

Forex Calculator With Leverage Investing Post

Calculating Pip Value And Forex Lot Sizes Optimizefx Com

What Is A Pip Forex4noobs Ubestari International

Calculating Pip Value And Forex Lot Sizes Optimizefx Com

Pip Value And Margin Calculator Excel Beginner Questions Babypips Com Forex Trading Forum

What Is A Pip Forex Trading Forex Com

How To Calculate A Pip Value Forex Education

What Is A Lot In Forex Trading Lot Sizes Explained

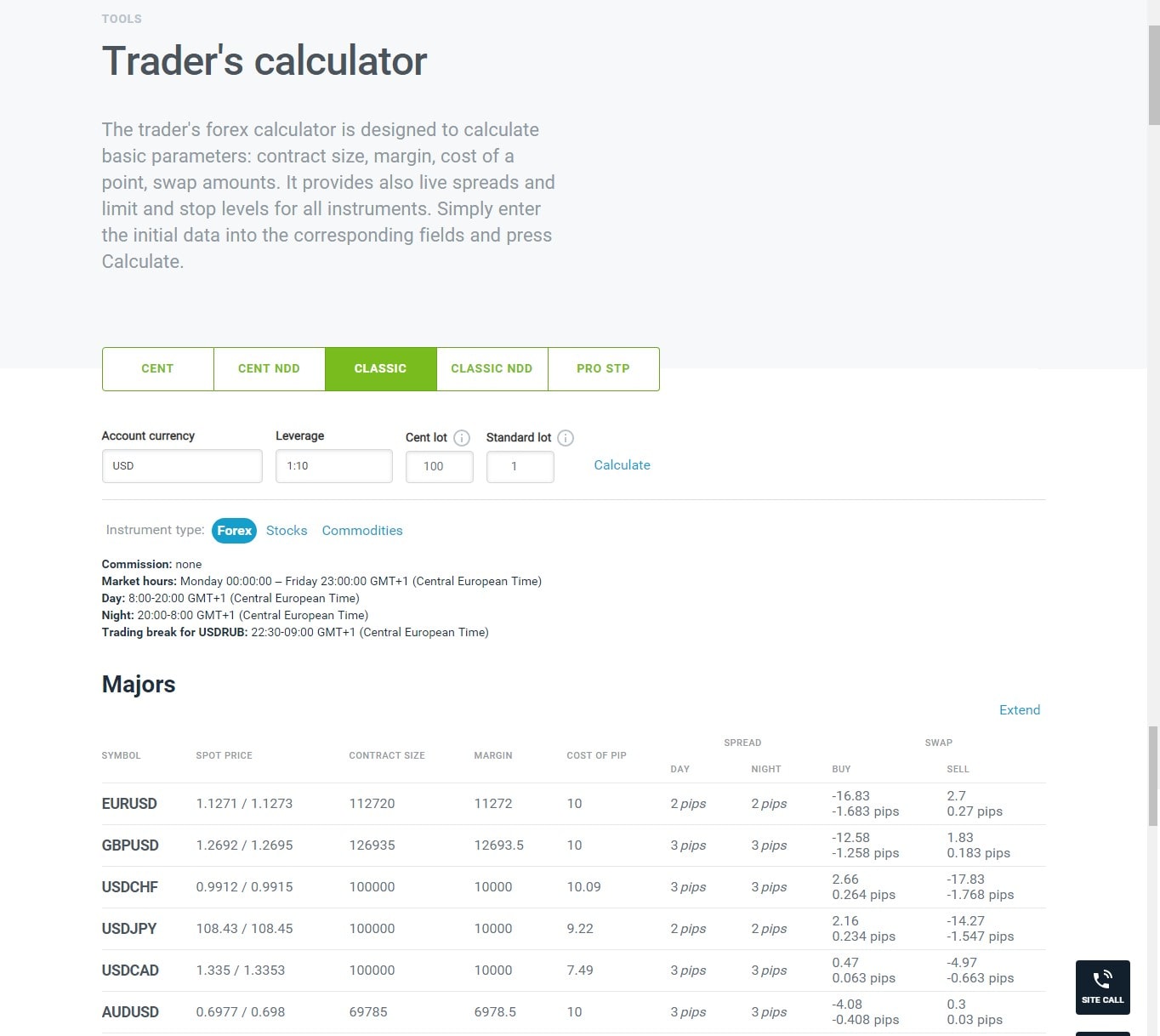

How To Use A Forex Leverage Calculator Forex4you

What Is A Pip In Forex Investoo Com Trading School Brokers And Offers

Comments

Post a Comment