Featured Post

How To Avoid Paying Taxes On Crypto Uk

- Get link

- X

- Other Apps

Assuming youre now in your mid twenties youve almost certainly taken out far more from the public purse than youve paid in. I strongly suggest you avoid paying taxes in any way possible.

How To Pay Zero Crypto Taxes On Crypto Profits Cointracker

Crypto Tax Calculator is one of them designed specifically for HMRC tax laws.

How to avoid paying taxes on crypto uk. Better yet you can avoid the high cost of professional accountants by using software services. Depending on your individual circumstances the tax obligations could become pretty onerous. The United States Securities and Exchange Commission SEC had already set its sights on Coinbase due to its crypto loan.

If playback doesnt begin shortly try restarting your device. It went up 6000 in value and youre trying to find convoluted ways to avoid paying just 20 tax on your gains actually less as c11k is tax free. Let your crypto insure your life.

There is one simple option available to cryptocurrency investors to not pay tax. You can use a paper wallet or an isolated digital wallet that is not connected to your own name in any way. You should still keep records of these transactions so that you can deduct the costs when you eventually sell them.

0000 Our tax bill isnt looking pretty. If you run a cryptocurrency trading or a mining business and receive an airdrop that will be subject to Income Tax at the time of the receipt regardless of you did something to get it or not. How can I avoid paying tax on Cryptocurrency UK.

Taxes are generally used by governments to further their control of the populous and usually in the most negative way possible. In the CoinTracker Tax Center your annual airdropped income will be shown on the Taxable Income card. Another less used method of avoiding paying taxes on your cryptocurrency gains is through a.

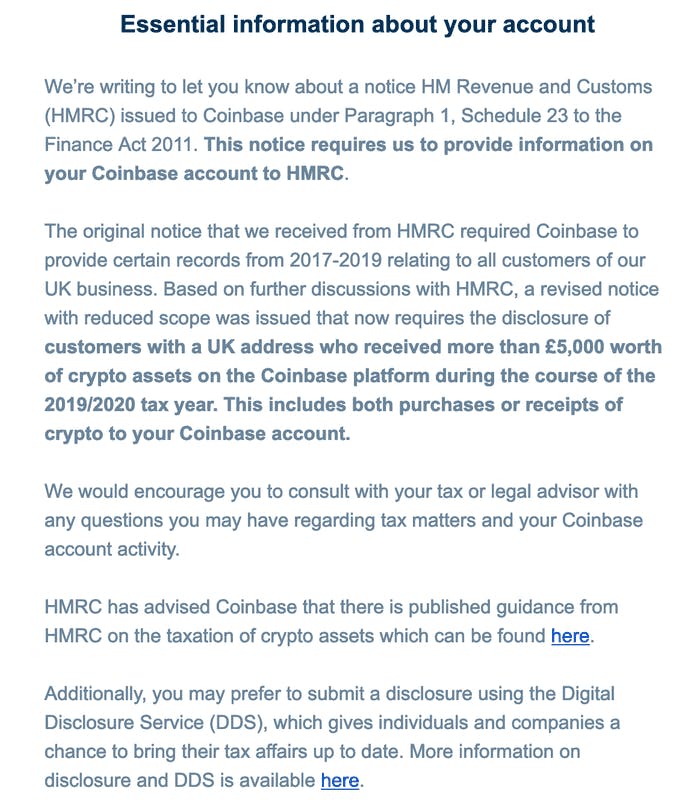

UK Crypto Tax Guide 2021 The tax collecting body of the UK HMRC Her Majestys Revenue and Customs has started to more aggressively enforce its crypto tax policies. Using this method the taxes are either deferred until the retirement account is distributed or completely fall off if the account is a Roth IRA which is completely tax-free. This comes from utilising the capital gains tax free allowance which is 11700 for the 201819 tax year.

If you have less than 100 cryptoasset transactions per year it may be worthwhile to pay the price of 39 per year to double-check if all of your crypto taxes are in order. As cryptocurrencies like bitcoin have grown in popularity over the years so has the amount. For example in the UK selling your crypto for fiat exchanging it for another asset or using it to pay for goods and services are all classed as taxable transactions.

Make use of ISAs and pensions claim reliefs you are eligible for but dont take the piss. When originally published in December 2018 this page contained guidance for individuals who hold cryptoassets explaining what taxes they may need to pay and what records they need to keep. The problem with the capital gains tax free allowance How to avoid cryptocurrency tax UK Selling and then buying again to avoid CGT Writing off previous losses Transfers of crypto to your spouse partner Tax tips tax software and Koinly etc.

Coinbase is just one among many crypto organizations that have faced regulatory action in the US Additionally UK Financial Conduct Authority FCA President Charles Randell recently made statements criticizing CRYPTOCURRENCY. Instead of using BTC or an altcoin buy a stablecoin like USDT Tether or USDC this is the stablecoin created by Coinbase and move that to the exchange. How You Can Get The Zero Crypto Tax Rate On Bitcoin For the savvy taxpayer there is a legal way to reduce taxes to zero on thousands of crypto profits.

Here are 4 ways to stop paying tax on your cryptocurrency gains and your capital gains. If you want to avoid tax on your cryptocurrency profits you must plan ahead. How To Avoid Crypto Taxes.

In essence if you make a gain of less then. GBP BTC There are no taxes on buying crypto in the UK or even hodling it for as long as you want. It works just like a dollar and of course buying a dollar for a dollar does not create a taxable event.

Common crypto tax scenarios Buying cryptocurrency eg.

How To Avoid Paying Taxes On Crypto Alto Ira

Cryptocurrency Taxes In The Uk The 2021 Guide Koinly

Avoid Paying Taxes On Cryptocurrency Legally Youtube

Uk Cryptocurrency Tax Guide Cointracker

Do You Have To Pay Tax On Cryptocurrency In The Uk

How To Avoid Paying Taxes On Crypto Everything You Need To Know Youtube

Cryptocurrency Taxes In The Uk The 2021 Guide Koinly

Get The Latest Update And News Of Cryptocurrency Cryptocurrency Cryptocurrency News Bitcoin

Dos Donts Of Money Cryptocurrency Happy Money Lifestyle Motivation Crypto Me I Dos Donts Of Money Management Advice Budget App Money Financial

How To Avoid Tax On Cryptocurrency Uk Youtube

Tax Professional Explains The Most Important Thing For Us Crypto Holders Capital Gains Tax Capital Gain Cryptocurrency

Can We Avoid Tax On Crypto Your Suggestions Explored Youtube

Your Crypto Tax Questions Answered Lexology

How To Avoid Paying Crypto Taxes Loophole Tax Cryptocurrency Avoid

How To Avoid Crypto Taxes Cashing Out Youtube

Jeff Garzik S New Altcoin Will Jump Blockchains To Avoid Infighting Fallout Paying Taxes Bitcoin What Is Bitcoin Mining

4 Ways To Pay Zero Tax On Cryptocurrency Gains Escape Artist

Budget 2020 Affordable Homes Get Tax Holiday Boost Income Tax Tax Payment Tax Attorney

Comments

Post a Comment