Featured Post

Do I Have To Pay Taxes On Cryptocurrency Gains Canada

- Get link

- X

- Other Apps

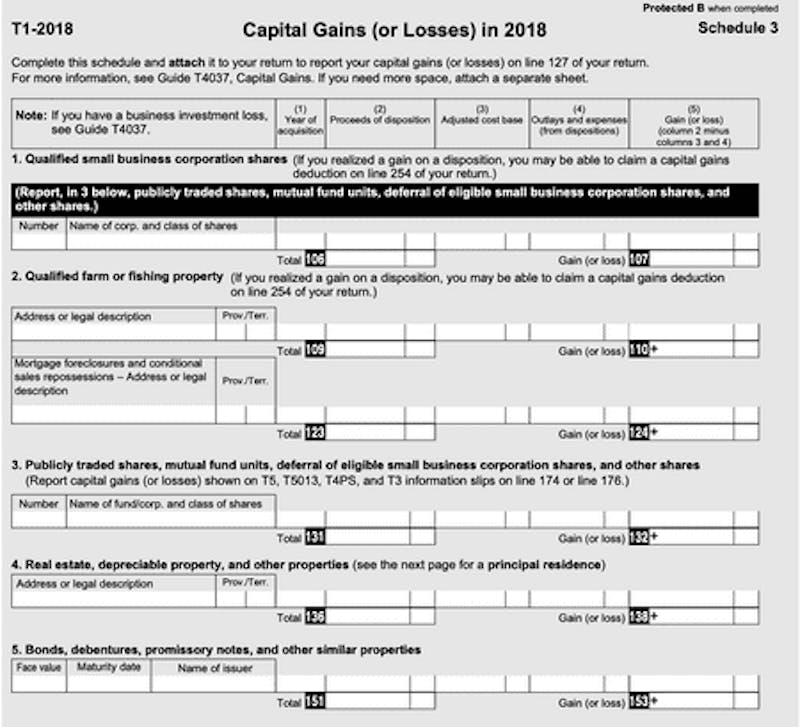

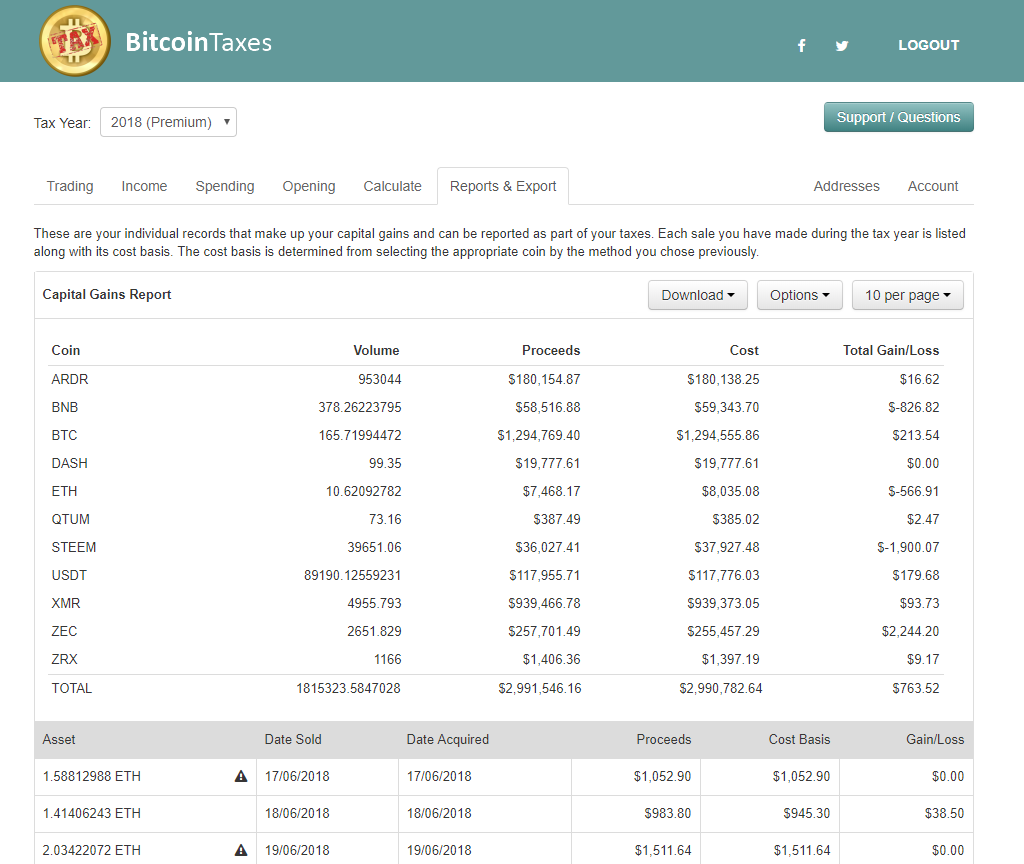

Trade or exchange cryptocurrency including disposing of one cryptocurrency to get another cryptocurrency. 50 of the gains are taxable and added to your income for that year.

Cryptocurrency Taxes In Canada Cointracker

This means when you dispose of your cryptocurrency by selling it trading it or using it to purchase something youll pay capital gains taxes on any gain youve realized.

Do i have to pay taxes on cryptocurrency gains canada. 100 of business income is taxable whereas only 50 of capital gains are taxable. However many countries have tax treaties with Canada to prevent double taxation. Depending on the circumstances crypto may be taxed as income or as property.

Any capital losses resulting from the sale can only be offset against capital gains. Investopedia requires writers Do I Have To Pay Taxes On Cryptocurrency Gains Canada to use primary sources to support their work. You cannot use them to reduce income from other sources such as employment income.

You may need to file form T1135 and will need to report income when you do. However you trigger tax consequences when you do any of the following. How Do Capital Gains Taxes Work.

Lets say you bought a cryptocurrency for 1000 and sold it later for 3000. How is cryptocurrency taxed in Canada. Cryptocurrency taxes are very real as are the consequences of ignoring tax liabilities.

If you sold or traded cryptocurrency even for other cryptocurrency you have a taxable event and must report it. When you buy and sell cryptocurrencies within a year the short-term gains are taxed as ordinary income. But the reality is way more complicated than just a simple yes or no.

This is called the taxable capital gain. 100 of business income is taxable whereas only 50 of capital gains are taxable. Sell or make a gift of cryptocurrency.

As you can see holding onto your crypto for more than one year can provide serious tax benefits. There are stiff penalties. Cryptocurrency is taxed in Canada as either capital gains or as income tax depending on whether your activity with cryptocurrency is considered to be as a business or not.

Cryptocurrency is taxed in Canada as either capital gains or as income tax depending on whether your activity with cryptocurrency is considered to be as a business or not. Capital gains from the sale of cryptocurrency are generally included in income for the year but only half of the capital gain is subject to tax. 30 Second Cryptocurrency Price Summary Current Bitcoin Price.

If you are in the highest income tax bracket your taxes on your long term capital gains will be 20 instead of 37 the highest tax rate for short term gains. If youre buying and selling cryptocurrencies youll pay capital gains taxes on the profits. The answer to the question- Do you pay cryptocurrency taxes in a single word would be yes.

If you own cryptocurrency but havent sold or traded it you dont need to report income on your return. Cryptocurrency is taxed like any other commodity in Canada. We also reference original research from other reputable publishers where appropriate.

Most countries including the US the UK and Canada treat cryptocurrency as an asset rather than as a currency. These include white papers government data original reporting and interviews with industry experts. However the tax rate depends on your taxable income and whether you held on to the cryptocurrency for at least a year.

It has been more than a decade that cryptocurrency has come into existence but the matter itself and its taxation is ambiguous for many. You may have to pay income tax in other countries as well as in Canada. If youre running a business 100 of your crypto-related business income is taxable whereas only 50 of capital gains are taxable.

In Canada Crypto is taxed as either capital gains or as income tax depending on whether your activity with cryptocurrency is considered to be as a business or not. In general simply possessing or holding a cryptocurrency is not taxable. 34977 Bitcoin price continues to hover just slightly below the 35000 Do I Have To Pay Taxes On Cryptocurrency Gains Canada.

Speak to a cryptocurrency tax specialist to find out exactly what rules and exemptions apply to your situation.

Crypto Taxes Canada 2020 Capital Gains Vs Business Income Youtube

Guide To Bitcoin Crypto Taxes In Canada Updated 2020

Is Bitcoin Taxable In Canada Cra Tax Treatment Of Bitcoins

Bitcoin Taxes In Canada Coinmama Blog

5 Best Ways To Buy Bitcoin In Canada Buy Bitcoin Bitcoin Good Credit

Must Know Crypto Laws In Canada For Bitcoin Investors Your Taxes Identity And Transaction Records Youtube

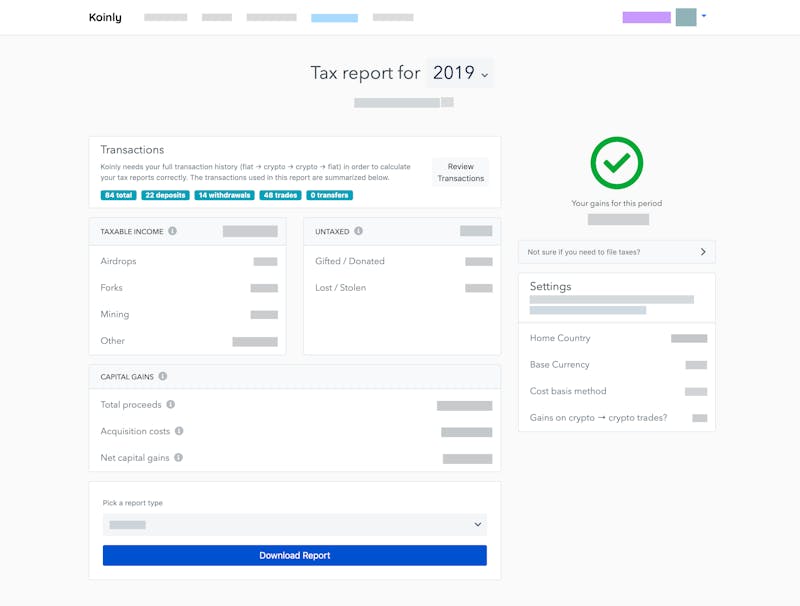

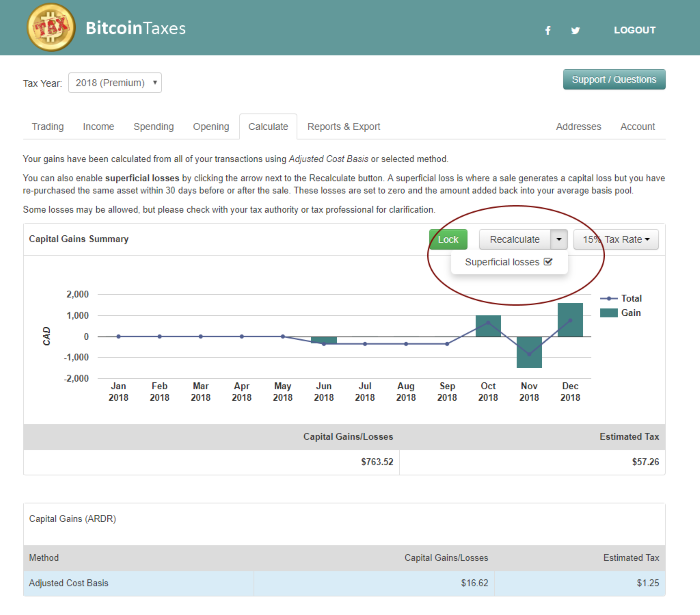

Calculating Crypto Taxes In Canada With The Superficial Loss Rule Koinly

Canada Calculate And File Bitcoin Cryptocurrency Taxes Coinpanda

Crypto Taxes In Canada Adjusted Cost Base Explained

Canada And Cryptocurrency Virtual Currency Laws Freeman Law

How To Declare Cryptocurrencies On Your Taxes In Canada By Iskender Piyale Sheard Medium

Declare Your Bitcoin Cryptocurrency Taxes In Canada Cra Koinly

Canada Calculate And File Bitcoin Cryptocurrency Taxes Coinpanda

Declare Your Bitcoin Cryptocurrency Taxes In Canada Cra Koinly

Crypto Taxes In Canada Adjusted Cost Base Explained

Cryptocurrency Taxes In Canada The 2021 Guide Koinly

Comments

Post a Comment