Featured Post

Do I Have To Pay Tax On Bitcoin Profit Australia

- Get link

- X

- Other Apps

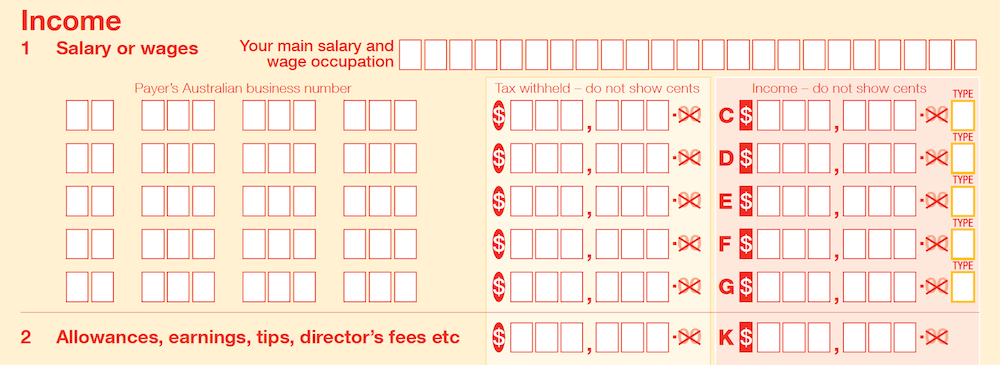

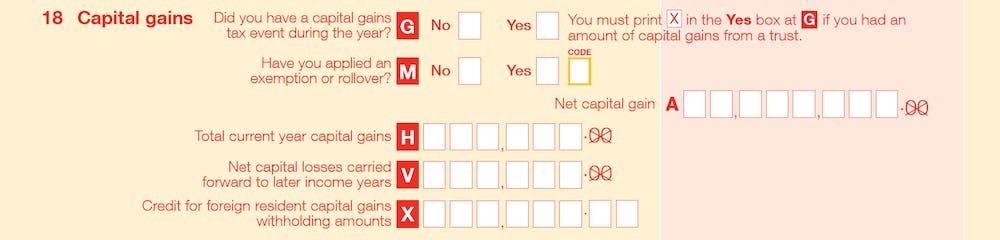

You may have to pay tax on any capital gain you make on disposal of the cryptocurrency. Do I need to pay tax on my bitcoin crypto profits and if so when and which tax.

Australian Cryptocurrency Tax Guide 2021 Koinly

Generally there are no income tax or GST implications if you are not in business or carrying on an enterprise and you simply pay for goods or services in bitcoin for example acquiring personal goods or services on the internet using bitcoin.

Do i have to pay tax on bitcoin profit australia. For tax-free treatment to apply you must satisfy the personal use conditions. Depending on your circumstances taxes are usually realised at the time of the transaction and not on the overall position at the end of the financial year. The annual subscription covers all previous tax years.

Do you pay tax on Bitcoin in Australia. If held for less than a year any profit may be liable for short-term capital gains tax. Like in most parts of the world there are no taxes on buying or hodling cryptocurrencies in Australia.

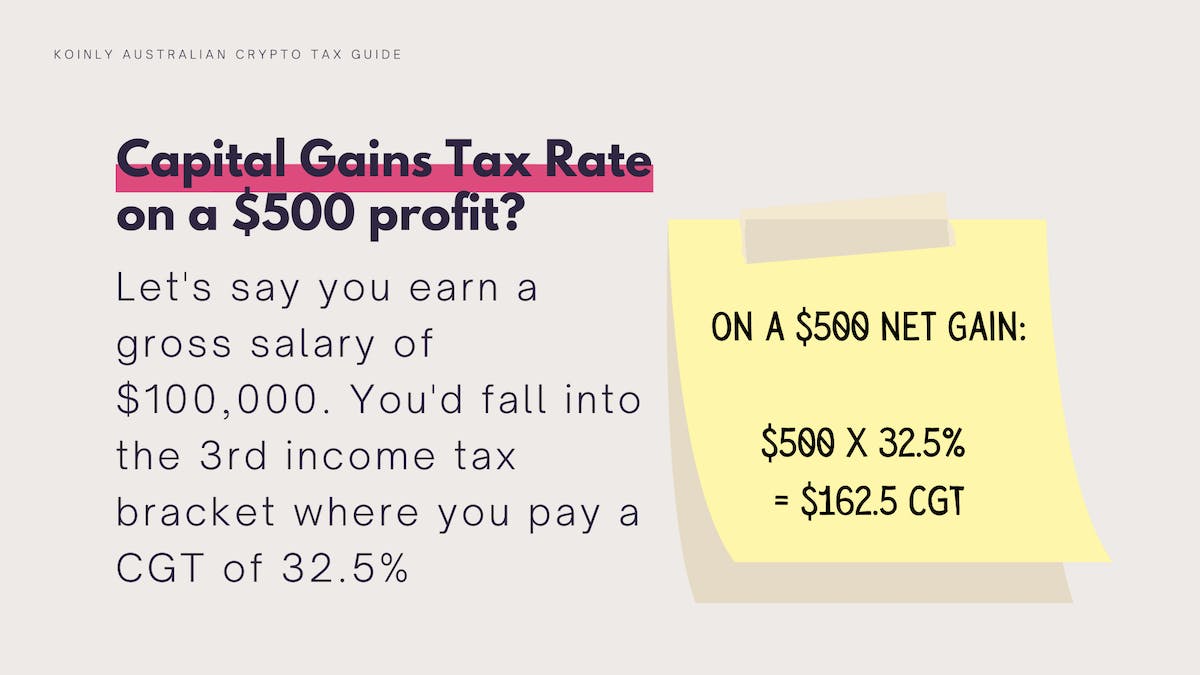

In your article where you write. That will determine your tax bracket and the tax rate on any Bitcoin profits. If you make a profit on the sale or trade of a cryptocurrency then some or all of the gain may be taxed.

Hey just came across your comment and was wondering. In short the answer is yes. Please read Australian Crypto Tax Calculator Promotion Details and Disclaimers.

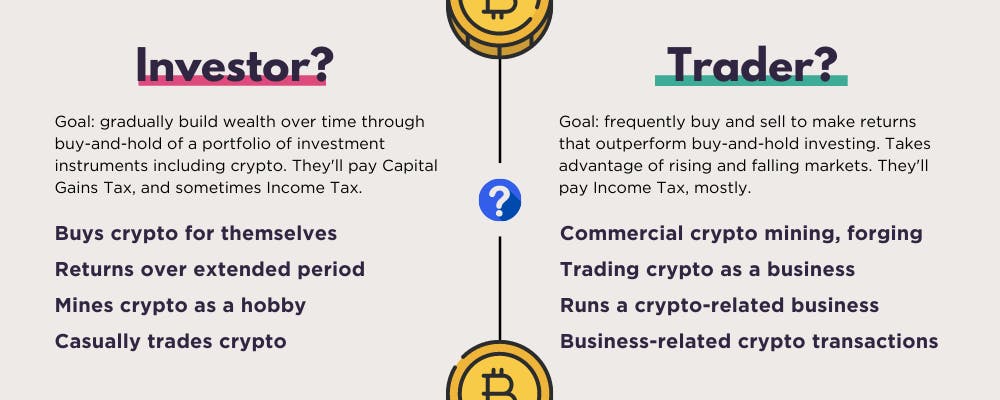

The profits you make on disposal will be assessable as ordinary income and not as a capital gain. In limited circumstances profit on the disposal of bitcoin can be tax-free. If held for longer than a year any profit may be liable for long-term capital gains tax.

What is your tax filing status and taxable income. However if you use bitcoin for investment or business purposes capital gains tax will apply. Note that if youre running an official crypto business that is youve registered yourself as a company with ASIC for the purposes of trading mining or any other crypto-related activity then youll pay the Australian company tax rate of 275 instead.

If you owned your crypto for less than 12 months the taxes you pay will be the same as your normal income tax rate. However keeping accurate records of the purchase is very important so that you can calculate the cost basis of the transaction when you decide to dispose of the crypto. Cryptocurrency generally operates independently of a central bank central authority or government.

Tax treatment of cryptocurrencies. However that rate only applies to profits. Generally speaking there are no income tax or CGT implications if you simply pay for goods or services in bitcoin ie.

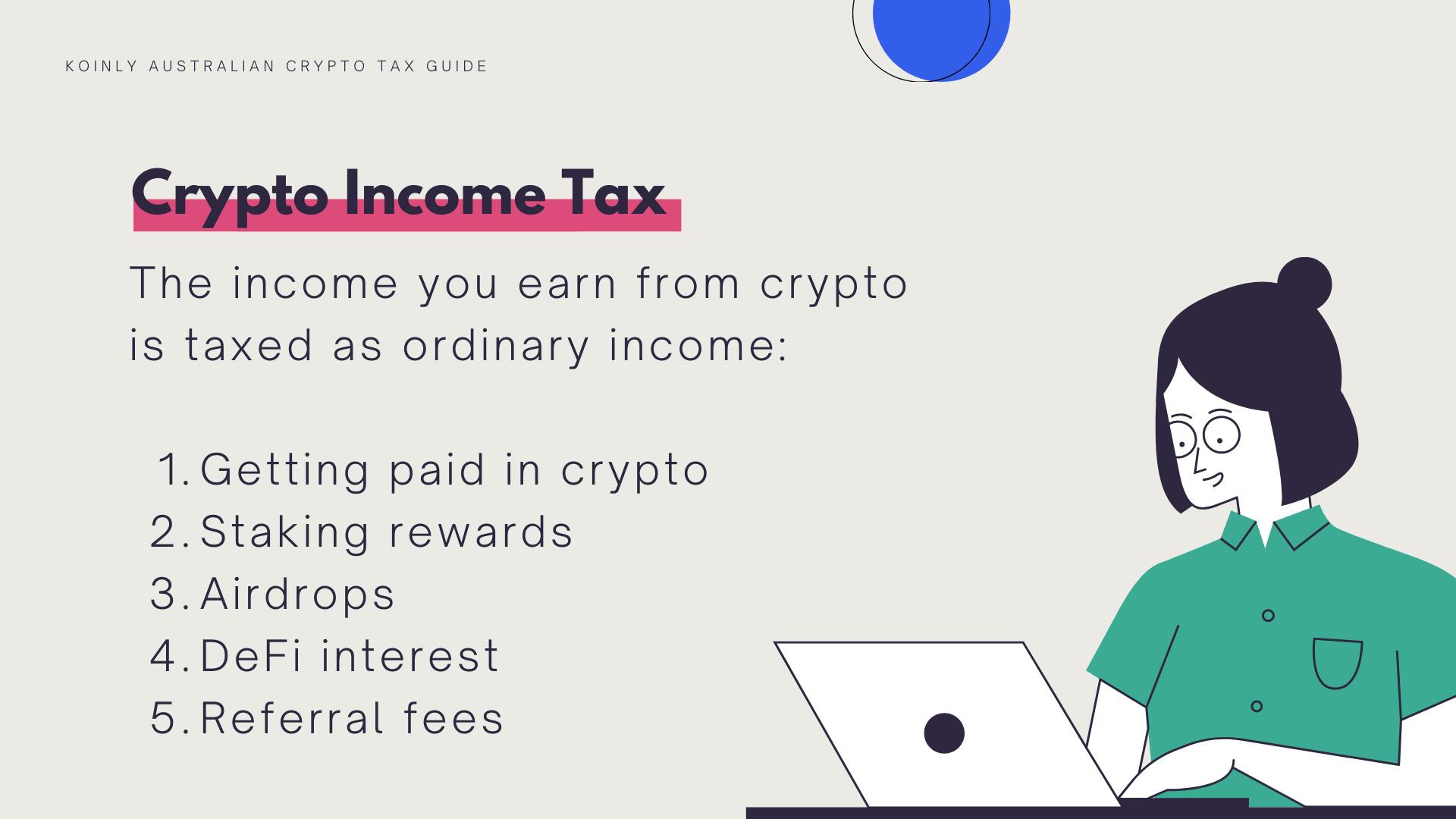

Those crypto profits may be treated as equivalent to personal or business income and therefore subject to the relevant type of income tax when the cryptocurrency was obtained in the course of. According to the Australian Tax Office Bitcoin is considered an asset for capital gains tax CGT purposes. The way cryptocurrencies are taxed in Australia mean that investors might still need to pay tax regardless of if they made an overall profit or loss.

For your personal use. The term cryptocurrency is generally used to describe a digital asset in which encryption techniques are used to regulate the generation of additional units and verify transactions on a blockchain. That means a CGT event occurs every time you dispose of your cryptocurrency.

This should not be considered as an endorsement of Crypto Tax Calculator products or services. Tax treatment of crypto-currencies in Australia - specifically bitcoin. However in contrast if your bitcoin activities were undertaken as part of profit making activities or your occupation included dealing in such kinds of assets or other similar forms of profit focussed activities then disposals of Bitcoin would be subject to tax as ordinary income irrespective of any CGT exemption.

The tax office also busted rumours that crypto gains are only taxable when holdings are cashed back into Australian dollars. If you sold your crypto for a loss theres some good news.

Australia Will Recognize Bitcoin As Money And Protect Bitcoin Businesses No Taxes Bitcoin Business What Is Bitcoin Mining Bitcoin Mining

Bitrefill Now Selling Doordash Gift Cards Bitcoin International Cryptocurrency News Bitcoin Gift Card Cryptocurrency News

Australian Cryptocurrency Tax Guide 2021 Koinly

Thank You Ameer Rosin Peter Schiff Finance Economy Silver Stock Fintech Currency Investing Forex Usd What Is Bitcoin Mining Bitcoin Bitcoin Mining

Australian Cryptocurrency Tax Guide 2021 Koinly

Australian Cryptocurrency Tax Guide 2021 Koinly

Cryptocurrency Taxes In Australia 2020 2021 Guide Cointracker

Australian Cryptocurrency Tax Guide 2021 Koinly

Cryptocurrency Taxes In Australia 2020 2021 Guide Cointracker

Australia Chases Crypto Investors For Every Tax Dollar Owed In Shakedown Cryptocurrency Market Capitalization Bitcoin Price Investors

Bitcoin Ledger How To Become A Bitcoin Merchant Getting Bitcoins Cryptocurrency And Making A Profit Bill What Is Bitcoin Mining Bitcoin Transaction Buy Bitcoin

Cryptocurrency Taxes In Australia 2020 2021 Guide Cointracker

Cryptosuite Review Live The Millionaire Lifestyle Money Cryptosuite Reviews Review Demo About With Images Profit Pay Rise Extra Money

Australian Cryptocurrency Tax Guide 2021 Koinly

Crypto Tax In Australia The Definitive 2021 Guide

1 Free Bitcoin 1 Bitcoin Giveaway What Is Bitcoin Ico Bitcoin Domain Current Bitcoin Conversion Best Cryptocurrency Best Cryptocurrency Exchange Cryptocurrency

How To Pay Bills With Bitcoin In Australia Digital Surge Paying Bills Bitcoin How To Pay

Australian Cryptocurrency Tax Guide 2021 Koinly

The Secret To Legally Paying Zero Taxes On Bitcoin Profits The Motley Fool

Comments

Post a Comment